As the financial year draws to a close, many of us start looking for ways to save tax. Often, it becomes

a hurried exercise. A receipt here, a form there, and the deeper purpose of giving quietly fades into

the background. But what if tax saving could mean more? What if it could genuinely change a child’s

life?

This tax saving season, donating to Light of Life Trust allows you to do both. You reduce your tax

liability while directly supporting children, families, and communities who need it the most.

Why Tax Saving Through Giving Matters

Under Section 80G of the Income Tax Act, donations made to eligible charitable organisations are tax

deductible. But beyond the financial benefit, thoughtful giving creates lasting impact. Your

contribution does not just sit on paper as a deduction. It reaches classrooms, homes, villages, and

young lives that need consistent support and opportunity.

For decades, Light of Life Trust has been working to break cycles of poverty by focusing on education,

community development, healthcare, and livelihood generation. Every donation supports sustainable

change rather than short-term fixes.

Where Your Donation Goes

Light of Life Trust works through well-defined projects, each addressing a critical gap in a child or

community’s journey towards a better future.

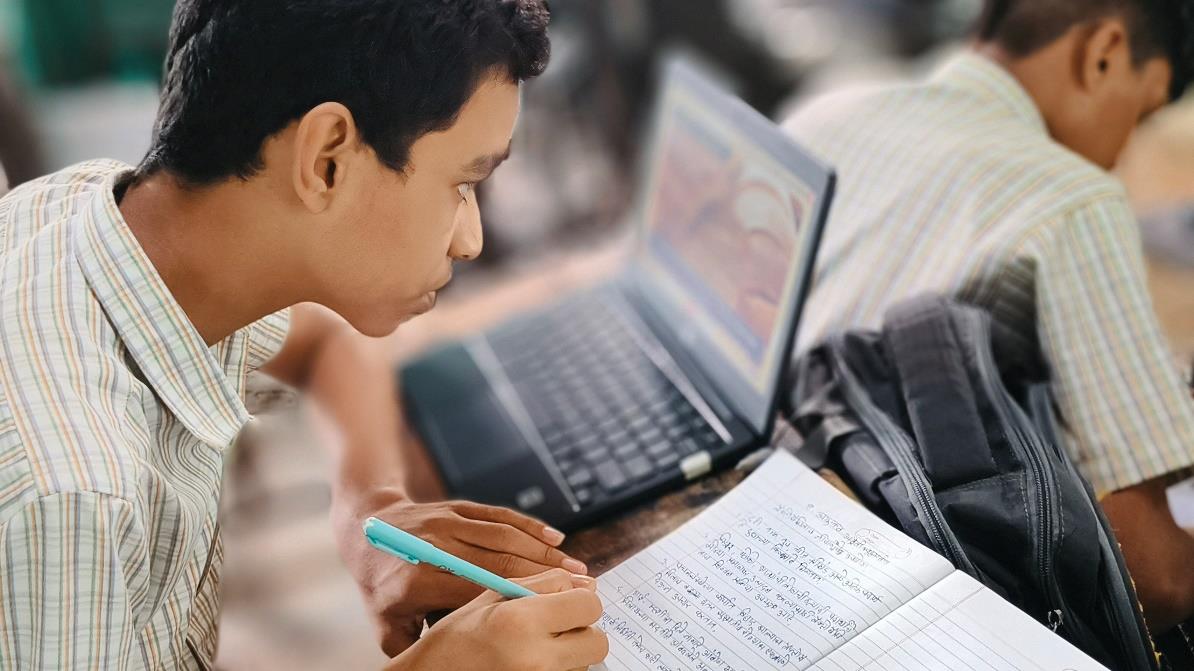

Project Anando focuses on ensuring that children from rural and marginalised communities complete

their secondary education and are prepared for life beyond school. The programme works with

adolescents to prevent school dropouts, delay early marriage, and build confidence and aspirations.

Through academic support, mentoring, exposure programmes, and career guidance, Anando helps

children move steadily towards higher education, vocational training, or meaningful livelihoods.

Project Jagruti is the Trust’s community development initiative. It works with rural families through

livelihood training, skill development for women and youth, primary healthcare outreach, and

environmental sustainability programmes. From mobile medical units to vocational courses and

income-generating opportunities, Jagruti strengthens entire communities so that children grow up in

healthier, more stable environments.

Together, these initiatives ensure that support goes beyond the classroom. Children are not only

educated but are surrounded by stronger families, healthier communities, and better opportunities.

How You Benefit Too

Donations made to Light of Life Trust are eligible for tax benefits under Section 80G, subject to

applicable limits. Once you donate, you receive the required documentation to claim deductions

while filing your income tax return.

In simple terms, you save tax while your money actively works towards keeping children in school,

empowering families, and building self-reliant communities.

Giving That Feels Right

Tax saving does not have to feel transactional. When you support Light of Life Trust, your

contribution becomes part of a much larger story. A story of a child completing school against the

odds. Of a young person discovering confidence and direction. Of families gaining stability and

dignity.

This tax saving season, choose to give with intention. Choose to invest in education, opportunity, and

long-term change.

Because the best kind of saving is the one that saves lives while it saves tax.